價格:免費

更新日期:2019-03-27

檔案大小:148.6 MB

目前版本:5.4.1

版本需求:需要 iOS 10.0 或以上版本。與 iPhone、iPad 及 iPod touch 相容。

支援語言:德語, 英語

Scalable Capital - Intelligent Investing.

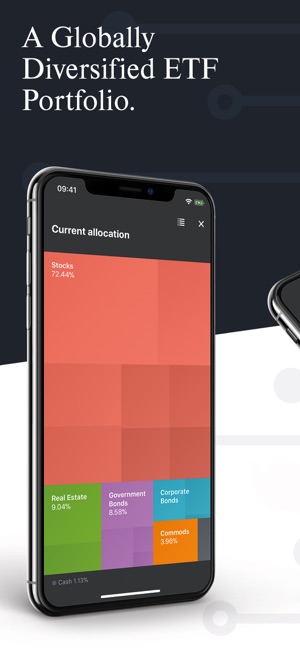

Personal, globally-diversified portfolio. ETF only. State-of-the-art risk management technology. Fixed fee. Open your account in the app - no paperwork required.

As featured in: Financial Times | Huffington Post | CNBC | The Telegraph

Scalable Capital offers busy professionals a convenient and intelligent way to build their wealth. We take care of your investments, so that you have more time to enjoy the good things in life. Here’s how it works:

IN A NUTSHELL

Hassle-free, cost-efficient and personalised wealth management

Globally diversified portfolio of low-cost exchange-traded funds (ETFs)

Risk management: dynamic reallocation to keep risk stable over time

Less stress and better risk-adjusted returns

UK only: Tax-free ISA or General Investment Account (GIAs). SIPPs available (not via app)

0.75% p.a. fixed fee for the investment services plus currently 0.15% p.a. cost for the financial instruments (ETFs). A detailed cost breakdown can be found on our website www.scalable.capital/fees

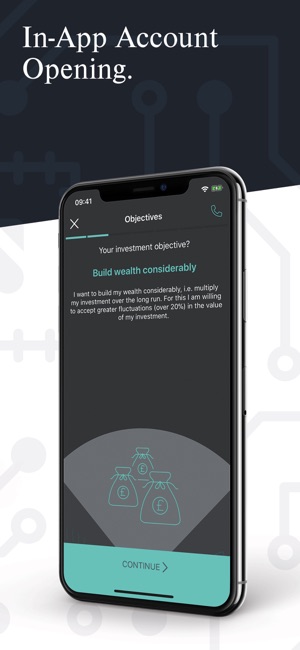

OPEN YOUR ACCOUNT IN THE APP

- No paperwork required

- Transfer ISAs and/or open a new one

- User-friendly questionnaire to determine your investment strategy

- No more typing: scan your personal details

- Use built-in GPS to look up your address

- Interactive investment planner

- Make a lump-sum payment

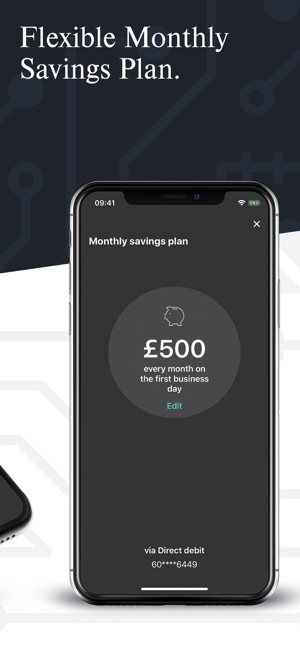

- Set-up a savings plan - you can cancel at any time

FUNCTIONALITY

- Check your portfolio valuation

- Review your performance (real-time)

- Make a deposit or a withdrawal

- Get full transparency on your portfolio allocation

- View and adjust your savings plan

- See all portfolio adjustments we made for you

- Access your electronic mailbox

- Contact our customer service team

INVESTMENT MODEL

- Globally diversified portfolio of low-cost exchange-traded funds (ETFs)

- The best ETFs from a universe of more than 2,000 ETFs

- All major asset classes: equities, bonds, commodities, and real estate

- Regular risk monitoring and dynamic adjustments to portfolio allocation

- Value-at-Risk (VaR) as a transparent and objective risk indicator - 23 investment strategies, with VaR increasing from 3% to 25%

- VaR measures the annual loss that will not be exceeded with a likelihood of 95%

- In 1 out of 20 years you should expect a loss exceeding the VaR

SECURITY

- Your account and private data are safe with us

- Bank-level security - we use 256-bit SSL encryption

- Your data is stored encrypted and securely

- Fraud protection - we protect your account from unauthorised activity

- Securities and bank account held with our partner bank

- Securities are segregated from the assets of the bank

- In case one of us goes out of business, you can reclaim your securities

- UK bank accounts are protected by the Financial Services Compensation Scheme (FSCS)

- German bank accounts are protected by the “Gesetzliche Einlagensicherung”

- Find out more about security on our website

Note: All figures shown in the screenshots are for illustrative purposes only. Past performance is not an indicator of future returns. Actual returns will vary greatly and depend on personal and market circumstances. Please remember that capital market investments involve risk, which means you may get back less than you have invested. Have a look at our risk statement on www.scalable.capital for more information.

支援平台:iPhone, iPad