價格:免費

更新日期:2019-06-22

檔案大小:36.4 MB

目前版本:2.2

版本需求:需要 iOS 12.1 或以上版本。與 iPhone、iPad 及 iPod touch 相容。

支援語言:英語

Value investors profit by investing in quality companies. Because their method relies on determining the worth of company’s stock, value investors don't pay attention to the external factors such as market volatility and daily price fluctuations. Their goal is to purchase shares determined to be undervalued.

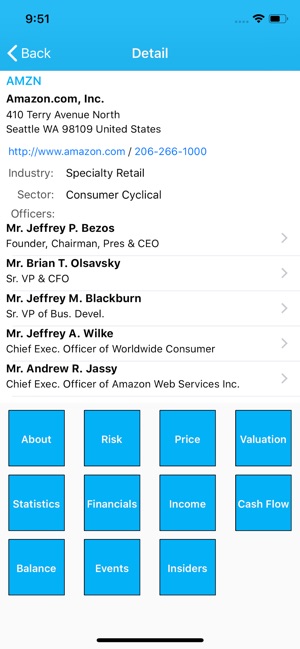

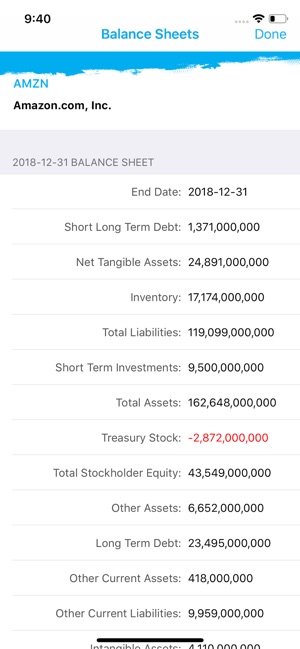

Company 360 pulls together data for publicly traded companies that includes company profile (address, business description, industry, key executives and their pay), risk, price, income, cash flow, balance sheets, insider, statistics and financials. Valuation process uses this data for formulas and key factors analysis. Note: Public data on funds and ETFs is collected but not evaluated.

Values investors look for:

* Below average price to book ratios

* Lower than average price to earnings (P/E) ratios

* Lower total debt to equity ratio

* Positive earnings

Valuation formulas that are applied:

*P/E Ratio Formula:

The most popular method used to estimate the intrinsic value of a stock is using the P/E ratio formula. Trailing P/E ratio is calculated by dividing the current price of stock by the total of its 12-months trailing earnings (trailing EPS). To calculate the current intrinsic value of stock, multiply trailing P/E ratio by the projected earnings per share (forward EPS).

Current Price of Stock / Trailing EPS = Trailing P/E Ratio

Trailing P/E Ratio * Forward EPS = Intrinsic Value

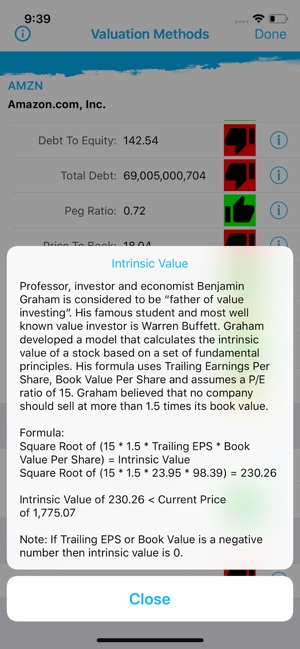

*Benjamin Graham Formula:

Professor, investor and economist Benjamin Graham is considered to be “father of value investing”. His books influenced many, including his most famous student Warren Buffett. Graham developed a model that calculates the intrinsic value of a stock based on a set of fundamental principles. His formula uses earnings per share, book value per share and assumes a P/E ratio of 15. Graham believed that no company should sell at more than 1.5 times its book value.

Square root of (15 * 1.5 (Trailing EPS) * (Book Value per share)) = Intrinsic Value

Interpreting results:

If intrinsic value of stock is higher than current price, then stock is undervalued and can be considered a BUY candidate. However, no single formula should be used exclusively in determining stock value. Value investor looks at the big picture that includes market conditions, management changes, news, competition and technology to make a decision.

Free features include:

* Retrieval and display of available public data (profile, risk, price, income, cash flow, balance sheets, statistics & financials) for selected equity, fund or ETF.

Subscription features include:

* Stock valuation that processes all collected data for selected company. Relevant data is displayed in key factors and is used in P/E Ratio and Benjamin Graham formulas to calculate intrinsic value of stock.

* Each data item and formula result is rated (red, yellow, green) to indicate if stock is potentially over or under valued.

* Detailed explanation of data used and received rating displayed via info button next to each item.

* Subscribe once and access all subscription features from all your iOS devices running the app.

Subscription options:

Each subscription offers one week free trial then

* $0.99 per month

* $1.99 every three months

* $3.99 every six months

* $7.99 per year

*Payment for subscription will be charged to your iTunes Account at confirmation of purchase.

* Subscriptions will renew within 24 hours before the subscription period ends and you will be charged through your iTunes account.

*All subscriptions offer one week free trial.

* If you purchase a new subscription during a free trial, you will forfeit any free trial period remaining from your first subscription.

* You can manage and cancel your subscription in your iTunes Account Settings at any time.

Note: Prices are equal to the value that “Apple’s App Store Matrix” determines is the equivalent of the subscription price in $USD.

Terms & Data Privacy: http://ultrajetsoftware.com/UltraJetTermsAndPrivacy.html

支援平台:iPhone, iPad